Subscribe to wiki

Share wiki

Bookmark

Binance P2P

Binance P2P

Binance P2P is a peer-to-peer cryptocurrency trading platform offered by Binance, allowing users to buy and sell digital assets directly with each other using various local fiat currencies and payment methods [1]. Its primary purpose is to facilitate direct transactions between individuals without the need for a traditional intermediary exchange order book [1].

Overview

Binance P2P functions as a marketplace where users can post advertisements to buy or sell cryptocurrencies at their desired prices and payment methods [1]. This peer-to-peer model means that transactions occur directly between the buyer and the seller [1]. The platform supports the exchange of major assets like Bitcoin (BTC), Ethereum (ETH), USDT, USDC, and BNB, among others [5]. It accommodates trading with over 100 local fiat currencies, including major ones like USD, EUR, CNY, and JPY [1] [4] [5]. To help users make informed decisions, the platform displays key performance metrics for each advertiser, such as their total number of completed orders, completion rate, and user feedback score [5].

The platform provides a framework for users to connect and trade, offering features that allow for customization of trading terms within advertisements [1]. While the transaction is peer-to-peer, Binance provides an escrow service to secure the cryptocurrency during the transaction process [1]. This mechanism locks the seller's cryptocurrency once a trade is initiated and releases it to the buyer only after the seller confirms receipt of the fiat payment [1].

The platform aims to offer a convenient way for users to convert between fiat and cryptocurrency, particularly in regions where traditional banking integrations with exchanges might be limited [1]. It emphasizes user control over trading partners and methods, facilitated through the creation and management of trading advertisements [1].

How it Works

Binance P2P operates on a peer-to-peer model where users trade directly with one another [1]. The platform facilitates this by providing a marketplace for users to post buy and sell offers, known as advertisements [1].

When a buyer initiates a trade based on a seller's advertisement, the specified amount of cryptocurrency from the seller is held in escrow by Binance [1]. The buyer then transfers the agreed-upon amount of fiat currency directly to the seller using the payment method specified in the advertisement [1]. After receiving and confirming the fiat payment, the seller notifies Binance, which then releases the cryptocurrency from escrow to the buyer's wallet [1].

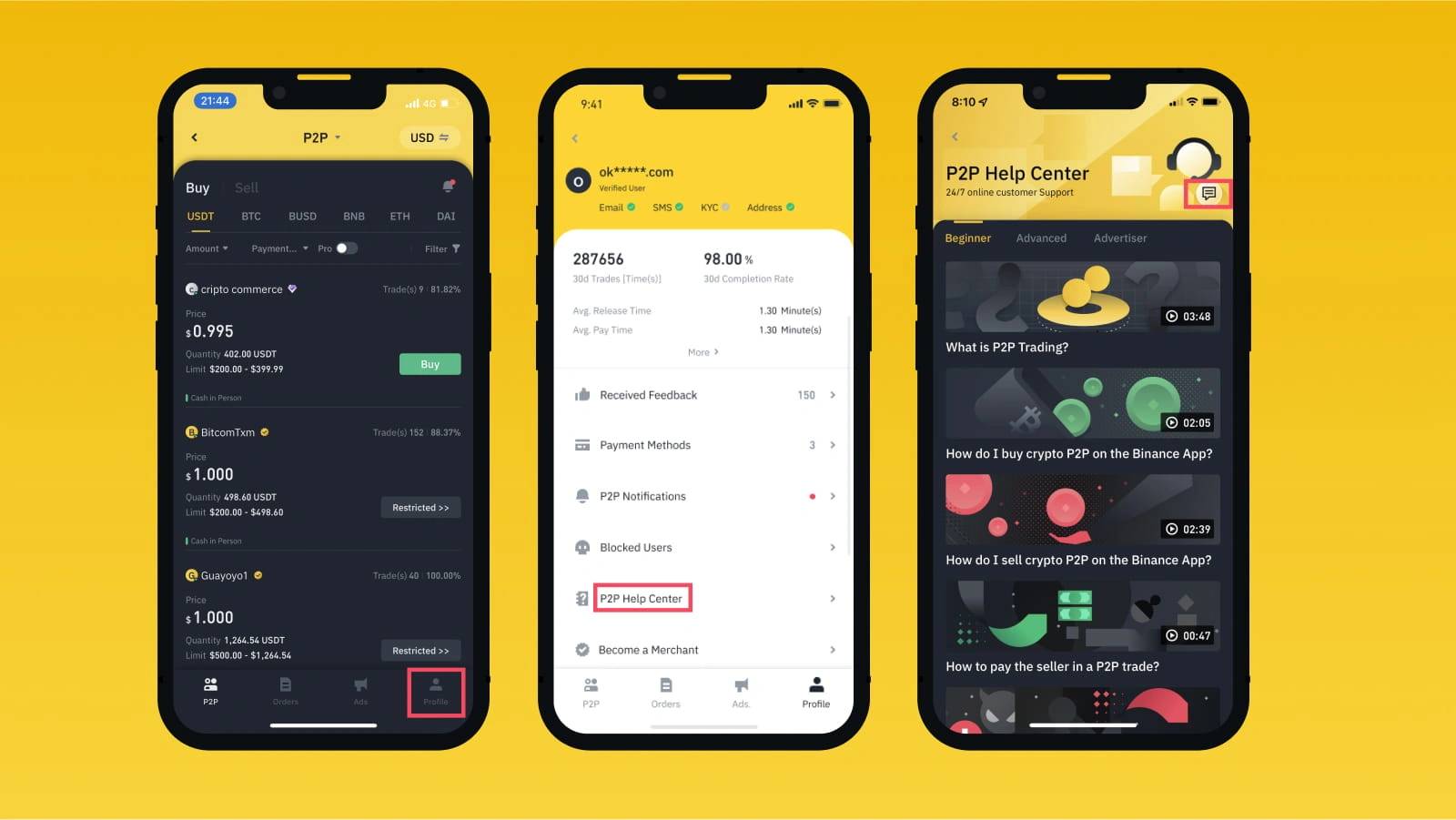

The platform includes a chat function for buyers and sellers to communicate during the transaction [1]. In cases of disputes, users can file an appeal. Binance provides customer support, including a live chat option and a comprehensive FAQ section, to assist in resolving issues [1] [4]. Users are advised to verify payment receipt independently before releasing cryptocurrency to avoid financial losses [1].

Trading Modes

Binance P2P offers several trading modes to cater to different user needs [5]:

- P2P: The standard marketplace where users can browse a list of buy and sell advertisements posted by other users and select their preferred counterparty.

- Express: A simplified interface for beginners that automatically matches a user with a counterparty for a quick transaction.

- Block Trade: A dedicated zone for high-volume transactions, allowing users to buy and sell large amounts of cryptocurrency securely [5].

Buying and Selling Process

To use Binance P2P, users must first register a Binance account and complete identity verification (KYC) [1]. The process for buying and selling involves several steps:

How to Buy Cryptocurrencies on Binance P2P

- Log in to the Binance account [1].

- Navigate to the P2P trading section, accessible from the homepage or under the 'Trade' section [1].

- Select the 'Buy' section and choose the desired cryptocurrency [1].

- Filter merchants by payment method and country/region if needed [1].

- Select a merchant based on their rate, terms, and reputation metrics like completion rate and user feedback [5].

- Enter the amount of fiat or crypto to trade and initiate the buy order [1].

- Proceed to the payment page to view the seller's payment information [1].

- Transfer the funds to the seller using the provided details within the given time limit (typically 15 minutes) [1].

- After transferring, click 'Transferred, notify seller' [1].

- Use the chat window to communicate with the seller and potentially provide proof of payment [1].

- Wait for the seller to confirm receipt of funds and release the cryptocurrency from escrow [1].

- The purchased crypto will be deposited into the user's P2P wallet [1].

- To trade or use the crypto on other Binance services, it must be transferred from the P2P wallet to the Spot wallet [1].

How to Sell Cryptocurrencies on Binance P2P

- Log in to the Binance account and navigate to the P2P trading section [1].

- Select the 'Sell' section and choose the cryptocurrency to sell [1].

- Browse available buyers and select one offering a suitable rate and payment method, taking into account their reputation metrics [5].

- Enter the amount of crypto or fiat for the transaction and select a payment method to receive funds [1].

- Place the sell order [1]. The transaction status will show "Pending Buyer's Payment" [1].

- Communicate with the buyer via the chat window [1].

- Wait for the buyer to transfer the fiat payment [1].

- Crucially, log in to the receiving bank or wallet account to confirm that the payment has been received from the buyer [1]. Do not rely solely on screenshots or notifications [1].

- Once payment is confirmed as received, click 'Confirm receipt' and then 'Confirm' to release the cryptocurrency from escrow to the buyer's account [1].

- If payment is not received or issues arise, use the chat or the 'Appeal' function to contact customer service [1].

Advantages

Binance P2P offers several advantages for users trading cryptocurrencies [1].

- Fee Structure: Binance P2P uses a maker/taker model. Takers, who buy or sell using existing advertisements, are generally not charged transaction fees. Makers, who create advertisements, may be subject to fees that vary by cryptocurrency. Users may also receive discounts on trading fees by using Binance's native token, BNB [1] [4].

- Multiple Payment Methods: The platform supports a wide array of payment options, allowing users flexibility in how they conduct transactions. These include general methods like bank transfers as well as numerous region-specific digital payment systems [1] [5].

- High Liquidity: As an integrated part of the Binance ecosystem, which serves over 275 million users worldwide, the platform benefits from high trading volume, facilitating large buy and sell orders [1] [2]. It has processed significant transaction volumes [1].

- High Completion Rate: Binance maintains standards for merchants on the platform, and key metrics like completion rates and user feedback scores are publicly displayed to encourage quick and satisfactory transactions [1] [5].

- Fast Transaction Speeds: Merchants can set transaction timers, with some trades completing within 15 minutes. The platform also displays an advertiser's average release time, giving users an indication of transaction speed [1] [5].

Security Features

Binance P2P incorporates several security measures to protect users during transactions.

- Escrow Service: To secure transactions for both parties, Binance holds the seller's cryptocurrency in an escrow service. The funds are locked when a trade is initiated and are only released to the buyer after the seller confirms that the fiat payment has been successfully received [1] [4]. This is part of the platform's broader security measures, which include a $1 billion Secure Asset Fund for Users (SAFU) [2].

- Identity Verification: All users trading on the P2P platform are required to complete identity verification (KYC), which adds a layer of security and compliance for all participants [5].

- Two-Factor Authentication (2FA): The platform supports 2FA as a standard security feature, adding an extra layer of protection to user accounts against unauthorized access [4].

Regulatory Scrutiny and Compliance

Binance, the parent company of the P2P platform, has faced significant regulatory scrutiny. In November 2023, Binance Holdings Limited reached a historic settlement with U.S. authorities, agreeing to pay over $4.3 billion—including a $3.4 billion penalty from FinCEN and nearly $1 billion from OFAC—to resolve investigations by the Department of Justice (DOJ), the Financial Crimes Enforcement Network (FinCEN), the Office of Foreign Assets Control (OFAC), and the Commodity Futures Trading Commission (CFTC). As part of the resolution, Binance's founder and then-CEO, Changpeng Zhao, pleaded guilty to violating the Bank Secrecy Act (BSA) and resigned from the company [3].

The investigations found that Binance had willfully failed to register as a Money Services Business (MSB) with FinCEN, failed to implement an effective Anti-Money Laundering (AML) program, and lacked sufficient Know Your Customer (KYC) procedures for many users. According to the U.S. Treasury, these failures allowed a range of illicit actors to transact on the platform, facilitating activities related to ransomware, terrorist financing, child sexual abuse material, and darknet markets. The company also actively subverted its own controls by instructing U.S. users on how to use VPNs to obscure their location and continue using the platform in violation of U.S. sanctions [3].

As part of its settlement, Binance is required to undertake a complete exit from the United States, enhance its AML and sanctions compliance programs, and conduct a "SAR lookback" to report previously unreported suspicious transactions. The company is also subject to a five-year independent compliance monitorship [3].

Beyond the U.S., Binance has faced regulatory challenges in other regions. For example, authorities in Nigeria have filed charges against the company related to tax evasion and foreign exchange manipulation [4].

Risks and Vulnerabilities

The U.S. Treasury's 2024 National Money Laundering Risk Assessment highlighted that P2P payment systems, including those transacting in virtual currency, are increasingly used by criminals for fraud and other illicit activities. While the report did not specifically name Binance P2P in this context, it identified the sector as a significant vulnerability for money laundering due to the speed and direct nature of transactions [3].

Common fraud typologies on P2P platforms include:

- Seller Scams: A scammer poses as a legitimate seller, receives a P2P payment for goods or services, and then fails to deliver the product.

- Money Mule Scams: Scammers use unwitting individuals (mules) to move illicit funds. This can involve sending money from a stolen source to a victim's account and instructing them to forward it, or making an "accidental" transfer and asking for the funds to be returned. In both cases, the initial fraudulent transaction is eventually reversed, leaving the victim liable for the money they sent [3].

The report also noted that virtual asset P2P platforms face specific compliance challenges. These include the risk of disintermediation, where transactions occur directly between users' unhosted wallets without a regulated intermediary, and regulatory arbitrage, where illicit actors exploit platforms in jurisdictions with weak AML/CFT controls [3].

Comparison with Remitano P2P

Binance P2P is often compared to other peer-to-peer trading platforms like Remitano [1]. Both platforms facilitate P2P cryptocurrency trading, but they have differences in features and fee structures [1].

| Criteria | Binance P2P | Remitano |

|---|---|---|

| Credibility | Both are described as prestigious P2P exchanges with over 5 years of operation in the international market . | Both are described as prestigious P2P exchanges with over 5 years of operation in the international market . |

| Transaction Fees | Free for buyers and sellers using existing ads; fees apply for active merchants creating ads. withdrawals are free . | Buyers may pay approximately 1% higher than the display price. A 1% fee is collected when withdrawing from a wallet . |

| Convenience | Integrated within the ecosystem, convenient for trading on spot markets. The broader platform supports over 350 listed cryptocurrencies . | Primarily supports around 20 coins . |

| Remitano is noted as popular in the United States, Vietnam, China, and South Asian countries . |

Instructions for Trading Coins

For information on spot trading on Binance, users can refer to guides on that specific topic [1].

Image: Illustration depicting Binance P2P as a peer-to-peer cryptocurrency trading platform [1].

Recent Platform Changes and Regulatory Compliance

In early 2024, Binance implemented significant changes to its P2P platform in Nigeria in response to intense regulatory pressure from the country's government [6]. The company removed the Nigerian Naira (NGN) from its P2P service, effectively ceasing all NGN-related trading pairs and payment options in March 2024 [7].

This action followed a crackdown by Nigerian authorities, including the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC), who accused the platform of enabling currency speculation and contributing to the devaluation of the Naira [6]. The situation escalated in February 2024 with the detention of two Binance executives in the country. The delisting of the Naira was part of Binance's efforts to comply with local regulations amid the ongoing dispute [7] [6].

See something wrong?